Notes on Britain's finances

This post is largely a summary of Paul Johnson’s book Follow the Money. Data is going to come from different years depending on the source; forgive the inconsistency.

Tax

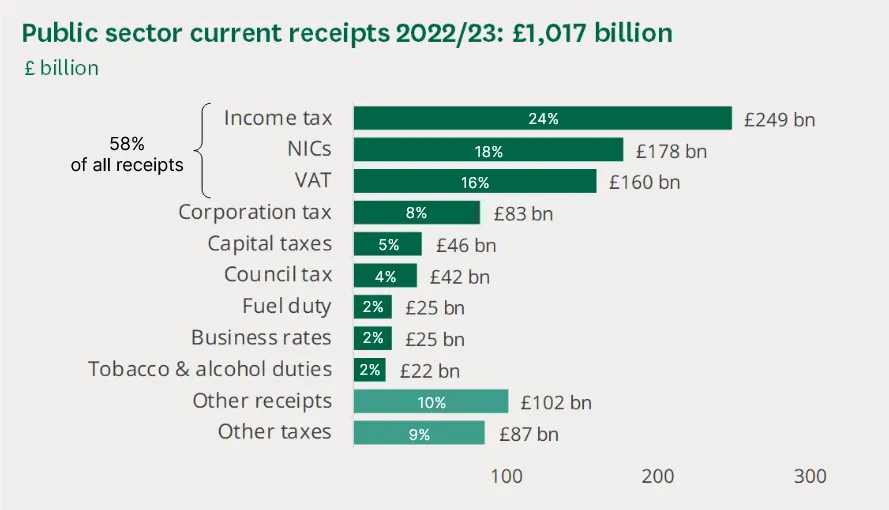

First we look at how the government gets money to spend. The majority of the government’s revenue comes from income tax, national insurance contributions, and VAT.

Income tax

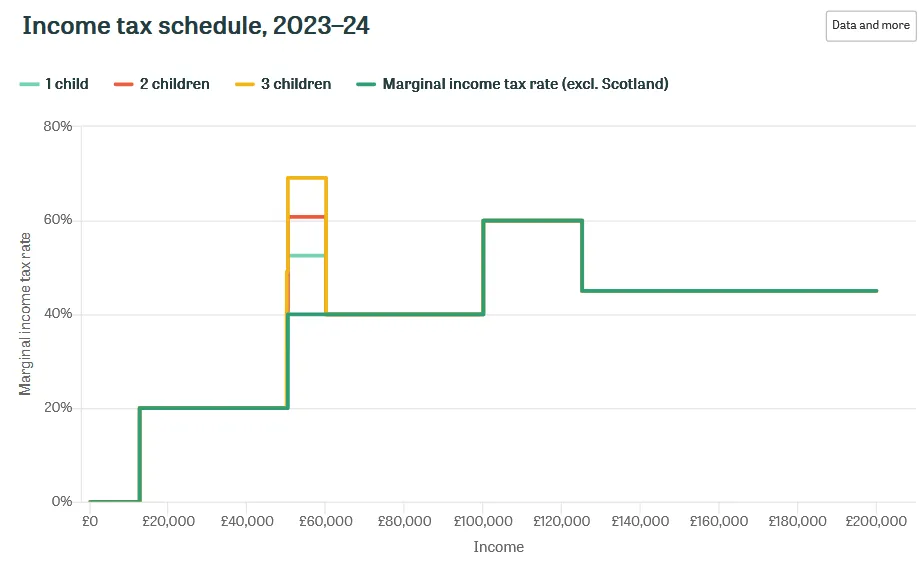

The income tax system is progressiveA progressive tax system imposes higher tax rates on higher incomes, ensuring that higher-income individuals pay a larger percentage of their earnings than lower-income taxpayers. A progressive system uses marginal tax rates, where the highest portion of the income is taxed at a higher rate, rather than the entire income being taxed at one rate (which could lead to a situation where earning slightly more money would actually result in a lower net income after taxes)., but weird. Most tables online will show this:

| Income band (£) | Marginal tax rate |

|---|---|

| 0 - 12,570 | 0% |

| 12,571 - 50,270 | 20% |

| 50,271 - 125,140 | 40% |

| Over 125,140 | 45% |

The tax-free allowance is £12,570, meaning income under this amount is untaxed. However, the allowance tapers off by £1 for every £2 earned over £100,000If you earn £100,001 the marginal amount taxed not just £1 for the earning above £100k, but also £0.50 taken away from the tax-free allowance. 40% x £1.50 = £0.60 = 60% tax on an extra pound earned., so the marginal tax rate is actually worse than what’s shown from £100k - £125k. Add to that child benefit reduction, and the income tax schedule actually looks like this:

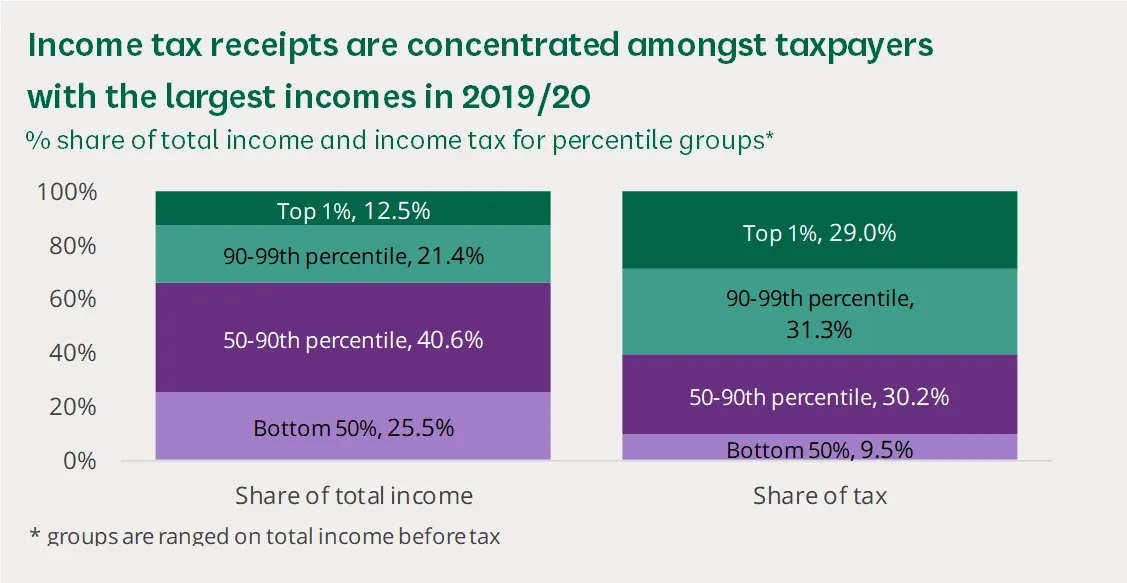

4 in 10 of adultsIncluding those of pension age., or over 20 million people, pay no income tax at all because they earn less than 12,570 annually. There are no good datasets for this group of people, so the following graphs and notes are based on the remaining 60% of adults who do pay tax.

- The top 0.1% of taxpayers earn over £650,000 annually.

- The top 1% of taxpayers earn over £190,000 annually and pay about 30% of all income tax.

- The top 50%, or a third of the adult population, pay 90% of all income tax.

National Insurance contributions

From Follow the Money:

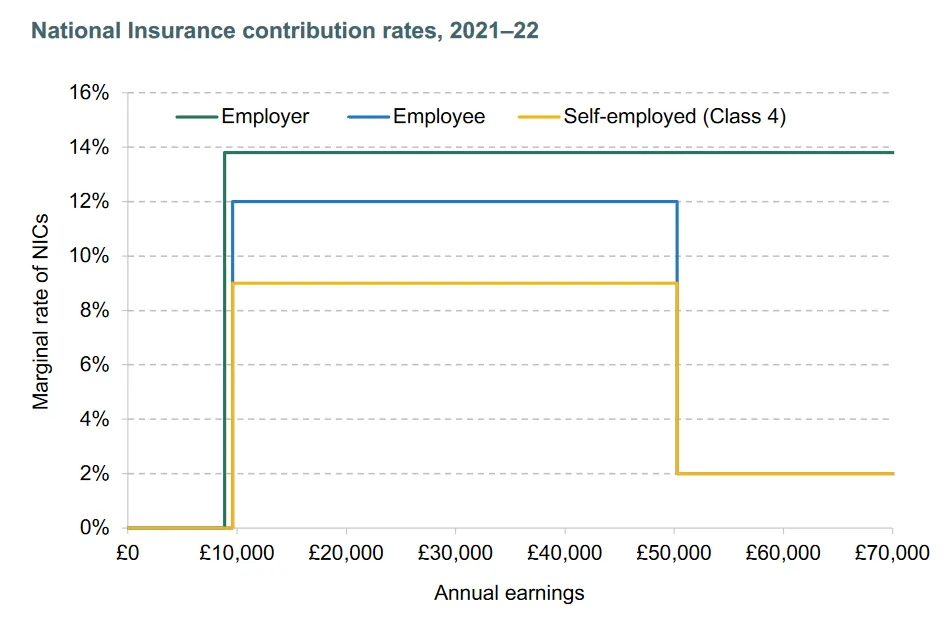

NICs [National Insurance contributions] were supposed to be something close to genuine insurance payments to cover the unemployment benefits, pensions and sickness benefits put in place in the 1940s following the Beveridge report (on which more in Chapter 3). They were originally paid at a flat rate in return for earning the right to receive a flat-rate benefit. Gradually they became earnings related. The Upper Earnings Limit, the point at which the rate for employees falls to 2 per cent, is a vestigial reminder of that old flat-rate contribution system.

The link between what you pay in NICs and what you are entitled to in benefits is now completely severed. Not only are there no earnings-related elements in the benefit system, there are almost no benefits for which your record of actually paying NICs matters.

National Insurance contributions are pooled into a fund which is used primarily to pay for pensions (£110b in 2022/23) and unemployment benefits (£4.5b).

Weirdly, NICs are not based on annual earnings, but monthly earnings (if you’re paid monthly) or weekly earnings (if paid weekly). There are different thresholds and rates for employees, employers, and the self-employed. The system is hard to understand in text so here’s a chart from 2021/22.

Because of the great rate of innovation in British tax policy, this chart is already outdated several times over. The most recent change was in November 2023, when the National Insurance Contributions (Reductions in Rates) Bill 2023-24 was passed. It reduced the rates of national insurance contributions from 12% to 10% for the employed and 9% to 8% for the self-employed, reducing government receipts by estimated £10b in 2024/25.

Notice that the rate for the self-employed is lower than the employed. This creates an incentive for people to register as self-employed. Paul Johnson suggests we remove the distinction between the employed and self-employed and fold everything into a single income tax. Makes sense to me.

VAT

A value-added tax is a general, consumption tax charged on most goods and services, borne by the final consumer. VAT is paid fractionally at each stage of production, so even if one firm evades the tax, the government still gets most of the money it is due. More details on how it works in general here.

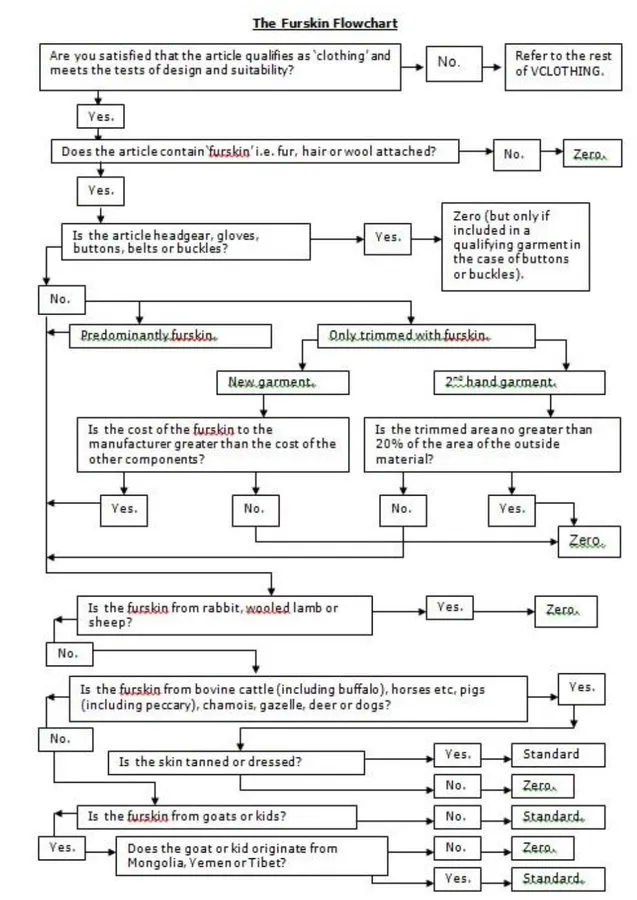

The standard rate of VAT is 20%. Some goods and services are exempt from VAT, and some are charged at a reduced rate of 5%, like domestic fuel and power, children’s car seats, and sanitary products. Public transport, most food, and children’s clothes are exempt. If these rules seem arbitrary and complex, I’d like to draw your attention to the fur skin flow chart.

Mongolian goats are taxed but Kazakh goats are not, god save us all.

Corporation tax

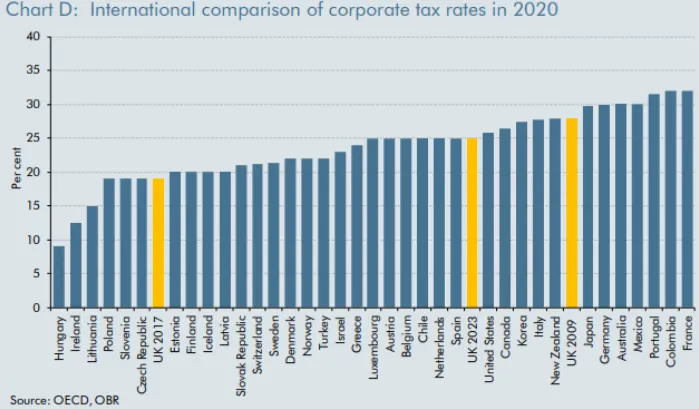

Corporation tax is levied at 25% of profits, which is on the high end compared to other countries.

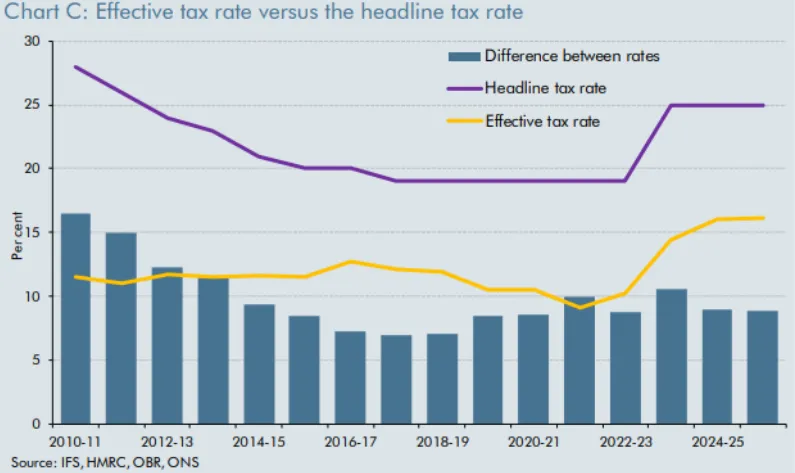

Studies find that high rates of corporation tax are amongst the worst for economic growth rates. That being said, the high headline rate isn’t necessarily a high effective rateEffective tax rate is defined as receipts as a share of overall profits. This captures the generosity and take-up of various reliefs and deductions that mean taxable profits vary relative to total profits. due to reliefs and deductions.

My guess is the high headline rate still discourages business investment.

Lastly, tax policy keeps changing:

We have also suffered from the most absurd lack of consistency. With the same party in power since 2010 we have had corporation tax slashed from 26 per cent to 19 per cent followed by an announcement that it would return to 25 per cent, then that it wouldn’t, and then that it would. We had years of the government boasting about increasing the income tax personal allowance. Now it is cutting it again. Even more than in any area of government spending there is no sense of strategy or direction.

Capital gains tax

The capital gains tax (the tax on the profit made from selling an asset) is 20%. There is a tax-free allowance of £6000 which is due to reduce to £3000 in the 2024/25 tax year.

Like most countries, capital gains tax is forgiven at death. Beneficiaries of a will only owe capital gains tax on the increase in value from the time of the original owner’s death, rather than from when the owner originally bought the asset.

Council tax

Council tax is a sort of property tax that is (you may sense a theme here) poorly implemented and regressive. A house was valued in 1991 and assigned to a band from A to H, and the tax is levied on that value. In general, properties in the band H are worth at least 8x those in band A, but council tax bills for the top band are only 3x those for the bottom. Properties have not been revalued since 1991.

Borrowing

Most of the government’s spending is financed by tax revenue, but some is financed by borrowing. The delta is typically a few percentage points of GDP. In 2022/23, the deficit was £137 billion (5.4% of GDP) on spending of £1,155 billion.

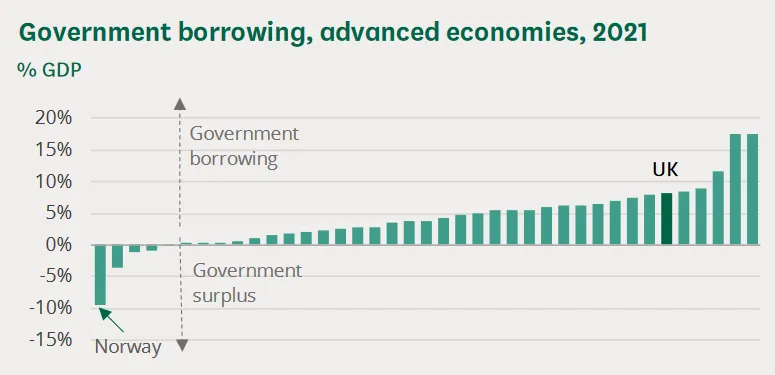

Compared to other advanced economies, Britain’s borrowing is on the high end as a percentage of GDP.

Spending

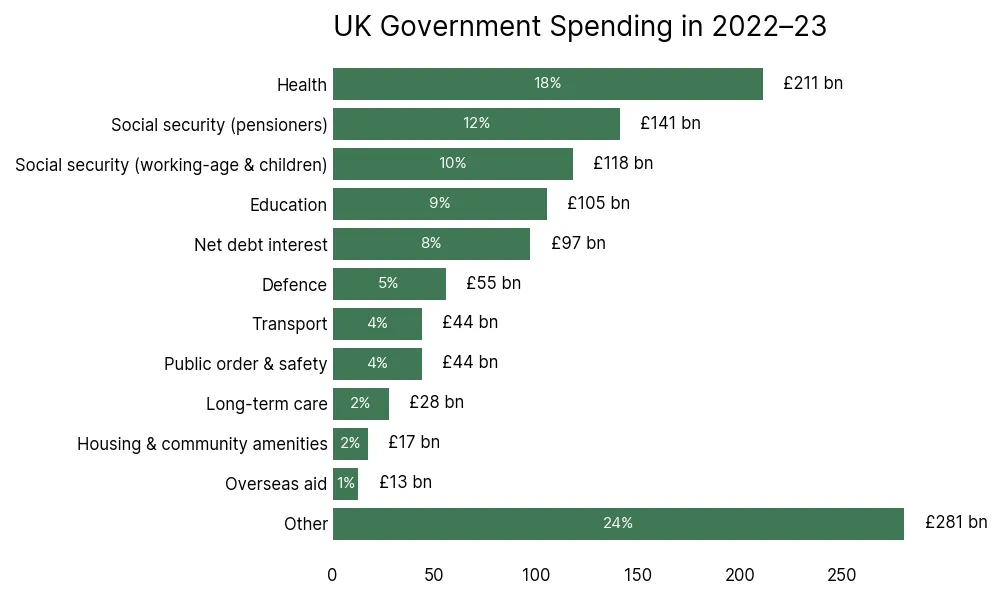

Total spending was £1,155 billion in 2022/23.

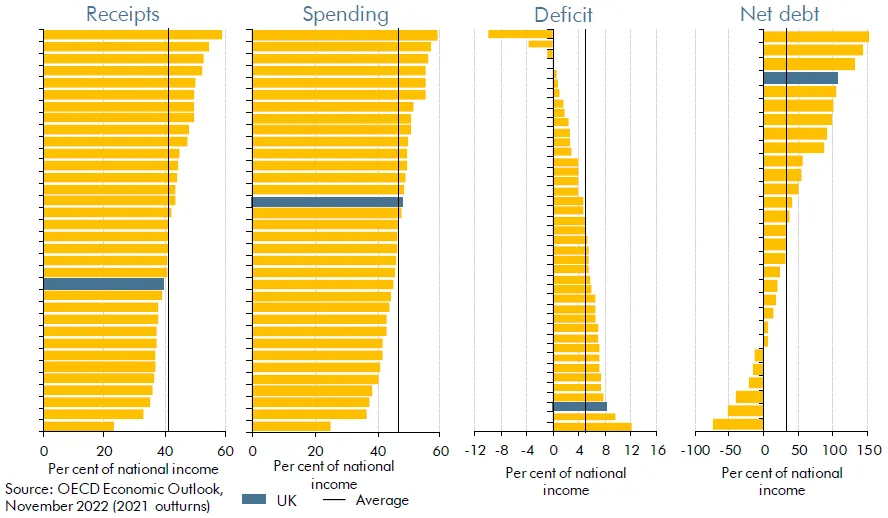

The UK spends about 40% of GDP on public services, which is about the same as other advanced economies.

The best description of what goes into ‘Other’ I could find is “smaller items (such as spending on science and technology and on recreation, culture and religion) and numerous accounting adjustments. We are here assuming that overseas aid is exactly 0.5% of GDP in 2022–23.”

Pensions

£135 billionThis number came from the book. It doesn’t match the chart above, but it’s close enough, so eh. of benefits were directed at pensioners in 2022/23, of which:

- State pension: £110 billion

- Public service pensions: £50 billion, of which £4 billion was unfunded by contributions110 + 50 ≠ 135. I don’t understand either.

Retirement legislation was originally introduced by David Lloyd George’s Old Age Pension Act of 1908. It was funded through general taxation, was means-tested, and available from age seventy to those of ‘good character’. I’m a little confused at the history, but it seems like pensions were originally a limited contributory scheme in the 20th century. Now nearly everyone older than 65 is entitled to a state pension of £185/week.

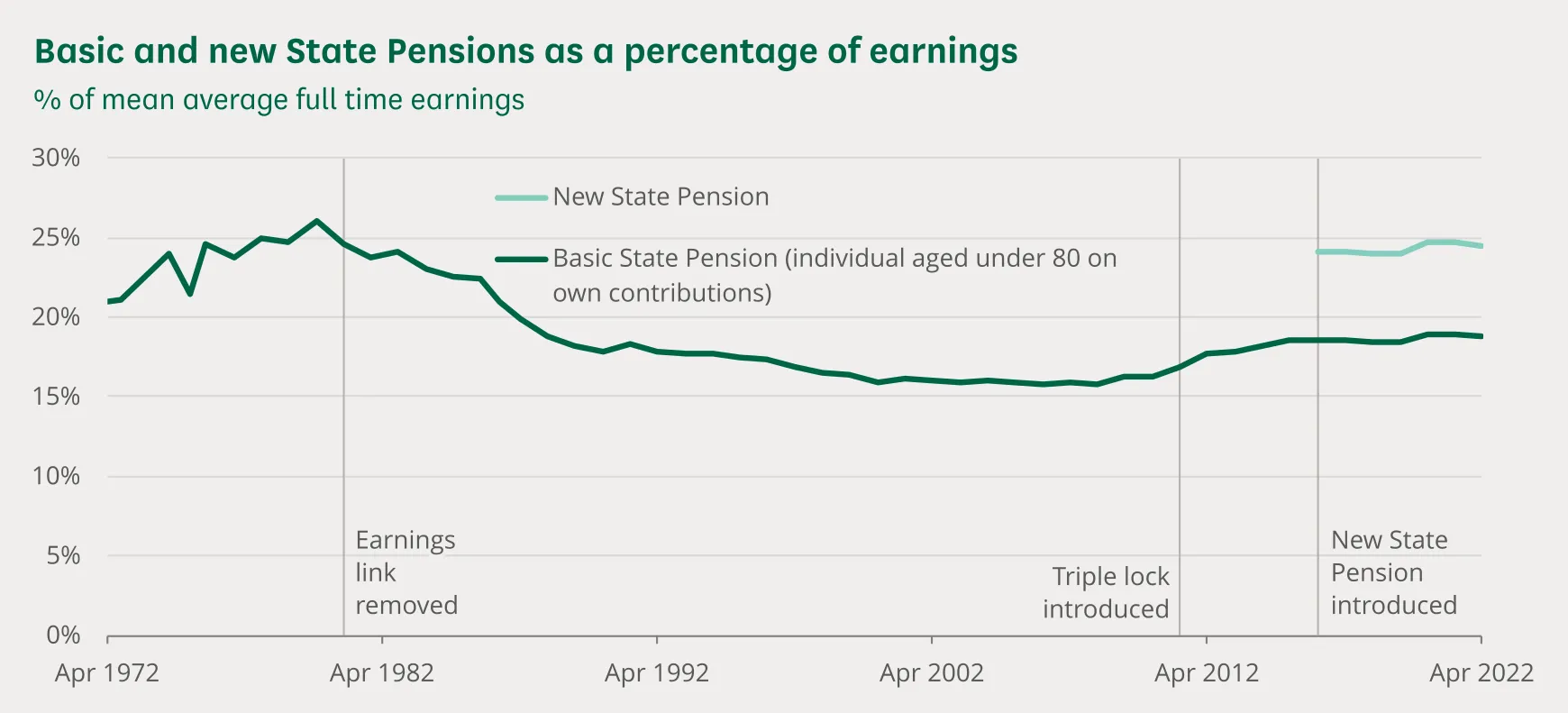

Since 2010, the state pension rises according to the “triple lock”: the highest of price inflation, average earnings or by 2.5 per cent. In 2010, the basic pension was only £5,078/year. The new state pension is now £8,122, an increase of 60%. And because of the triple lock, it is set to keep on increasing in a way that is unforecastable.

The new state pension is currently worth 24% of average full time earnings.

In addition to the state pension, public workers like retired doctors, nurses, civil servants, police officers are entitled to a public sector pension. The government currently spends £50 billion a year on these pensions. The government also seems to overpay for these pensions:

Indeed, in the absurd fact that a long-term low earner working in the NHS (say earning in the low £20,000s) will retire on a higher income than they ever had in work, once you add the state pension to their NHS pension. That just makes no sense. We’d be much better paying them more now and having a less absurdly generous pension.

In the private sector, 90% of employees are putting money into an employer-sponsored scheme, a proportion that has more than doubled since a decade ago. This is likely because of auto-enrolment legislation that took effect in 2012.

Pensions will cost even more in the future:

If, however, we keep the triple lock and don’t increase pension age to sixty-eight until 2046 as currently legislated, then spending will rise by more like 2.5 per cent of national incomeNational income includes income from abroad whereas GDP does not. In the UK both numbers are pretty much the same., or £50 billion. That’s a serious increase requiring some bumper tax rises.

Health

Most of the healthcare budget goes to the NHS. Health accounts for around two pounds in every ten that the government spends, and four pounds in every ten spent on public services. Spending will have to rise 3-4% yearly based on research from the IFS and The Lancet. This means an extra £100 billion a year on health and social care by the early 2030s.

About 40 per cent of the total budget goes on staff costs.

In terms of total health spending, the UK’s 10 per cent of national income is almost exactly the average of other rich countries.

I won’t be able to give a full treatment of the NHS in this post without many more words. Instead I’ll higlight some excerpts from Follow the Money.

Health outcomes

The gap in healthy life expectancy is even bigger — almost two decades. Those living in the most deprived areas spend nearly a third of their lives in poor health, compared with about a sixth for those in the least deprived areas. Not only do the poor have the shortest life spans, they also live more years in poor health. These inequalities are growing. Men and women in wealthier areas enjoyed significant increases in life expectancies during the 2010s. Those in the poorest areas did not.

While the number of people living with a single chronic condition has grown by 4 per cent a year - outpacing population growth - the number living with multiple chronic conditions grew by 8 per cent a year in the decade up to 2016.

People with long-term conditions now account for about 50 per cent of all GP appointments, 64 per cent of all outpatient appointments and over 70 per cent of all inpatient bed days. Their treatment and care is estimated to take up around £7 in every £10 of total health and social care expenditure.

… on health care outcomes, the Commonwealth Fund rates the UK ninth out of eleven major countries with only Canada and the USA behind.

Employment

The NHS alone employs something like 1.8 million people. The health and care system as a whole employs perhaps one in eight of the entire British workforce. … That makes the NHS one of the world’s biggest employers.

Since Brexit the proportion of new nurses coming from EU countries has plummeted from 15 per cent of all new nurses to just 2 per cent. The fraction coming from the rest of the world has risen from 5 to 13 per cent. We swapped European nurses for those trained in developing countries, particularly India, the Philippines and Nigeria.

Capital spending

Another area of health spending that has been cut — by more than a third between 2009 and 2016 — was the capital budget. Despite subsequent increases it was still nearly 10 per cent below its 2009 level in 2019. That’s a cut to spending on medical equipment of the kind that has high up-front costs but which will have benefits that last for years. Failure to invest in such equipment thus creates costs which last for years. A health service which saw day to day spending rise by over 20 per cent and capital spending fall by 10 per cent over a decade is not likely to be a sustainable one. In terms of total health spending, the UK’s 10 per cent of national income is almost exactly the average of other rich countries. But health capital spending, at just 0.3 per cent of national income is about half as much as the typical high-income country.

Medicine costs

The drugs bill meanwhile accounts for about one pound in seven of spending, roughly evenly split between GP prescribing and drugs and medicines used in hospitals. Prescription charges raise a tiny amount — less than £600 million out of the NHS’s £180 billion budget; ironic perhaps given how hotly contested their introduction was, leading to the resignation from the cabinet of Aneurin Bevan in 1951. One reason they raise so little, despite setting me back over £9 a time whenever I need one, is that about 90 per cent are free. We exempt the over sixties, the poor, children, and those with long term repeated needs for drugs.

Also

The King’s Fund has more charts and details on the NHS.

Social care and benefits

In 2021/22, spending on —

- Adult social care: £22 billion (England only)

- Employment and Support Allowance: £13 billion

- Other benefits for disabled people of working age: £20 billion

- Benefits for disabled people over pension age: £11 billion

More excerpts, emphasis mine.

Among people without a disability, more than 80 per cent are now in work, probably the highest rate in history. Yet only half of those with a disability are in paid work, dropping to only one in three of those with mental health problems. … About a fifth of people of working age say that they have some form of disability and more than four million of them are out of work.

Disability benefits [are] designed to help with the living costs of those who have a disability, irrespective of whether they are in work or not, and on an entirely non-means-tested basis. As with much else in the benefit system this is big money - around £20 billion a year or around 1 per cent of national income. About £15 billion of that goes to those of working age.

With a workforce of around 1.5 million, the social care sector employs a similar number to the NHS. Around 840,000 people were receiving publicly funded long-term care in 2020/21, with more than 200,000 in receipt of short-term, time limited care.

Of the 840,000 in receipt of long-term care nearly 300,000 are actually under the age of sixty-five … the under-sixty-fives account for around half the annual budget … a continuing rise in numbers of younger adults in need of care: one of the consequences of a health care system that keeps more children alive into adulthood, but with severe needs.

Of those requesting help in 2019/20, only around four in ten got some form of service, three in ten got some advice about where they might get help, and a further three in ten got nothing at all.

All that care is the main business of our local authorities, accounting for well over half their expenditure.

Local government

England is almost uniquely centralized in tax, spending, and policy-making, with little power being granted to local government. Councils are increasingly reliant on council tax to finance spending: 50% of their revenue comes from council tax, compared to 30% in 2010. Another 25% of their revenue comes from the element of business rates they get to keep. The last 25% is from central government grants.

Because of the centralization of revenue, and also because of the growing care burdens of an ageing population, councils have had to cut what they spend on housing, transport, planning, and cultural and leisure services by 40 per cent or more per person. More than half of everything they spend now goes on providing social care for adults and children.

Council tax and their other incomes aren’t enough, so some local authorities have resorted to more creative means to raise money:

Spelthorne, a local authority near London, with a core annual budget of around £11m, borrowed more than £1 billion to build a property portfolio mainly outside its own area. Thurrock in Essex borrowed five times its £220 million budget, much of it then invested in renewable energy projects. Portsmouth even bought a large banana export company. In fact, local authorities spent £6.6 billion on real estate between 2016 and 2019, according to the National Audit Office - fourteen times more than in the previous three-year period.

Education

Schools

£53.5 billion was spent on schools in 2022/23. The government spends about 5% of national income on public education, which is the same proportion it did in the 1980s. However, since 2010, spending per pupil has fallen around 9% and real pay for teachers has fallen by more than 10%. Johnson doesn’t make this clear, but I think this is because of a growing population of school-age children.

On the closely related topic of childcare, Johnson writes:

All three- and four-year-olds have a right to fifteen hours a week of free childcare, with another fifteen hours a week for those with working parents. Over 140,000 disadvantaged two-year-olds also get free places. The government spends £4 billion a year on these programmes. There is in addition an array of benefit entitlements to help poorer families pay for childcare from which around 300,000 families benefit via the tax credit and Universal Credit systems. Over 400,000 benefit from tax free childcare. Total spending runs into the billions, and parties now regularly compete with each other at elections to promise more.

Higher education

Public spending on —

- Further education and sixth form colleges (16-19): £4.5bn in 2022/23

- Apprenticeships across all ages: £2.3bn in 2021/22

- Adult education: £1.5bn in 2021/22

- Total tuition fee loans for English domiciled undergraduates in 2021/22: £10.3 billion

85% of 16-year olds are now in full-time education, compared to 40% in the 1980s. After completing schooling, about 50% of young people go into university. Probably as a result of goodharting university admissions, the numeracy and literacy of 20-year olds is worse than many OECD countries. 1 in 10 students are judged not to have basic literacy and numeracy skills.

The government can give undergraduates a loan to cover annual university fees of £9,250 (this is the most universities are allowed to charge citizens). Post-graduation, beneficiaries of the loan repay a portion of their earnings above a certain threshold via the tax system. If they’re unable to pay off the loan in 30 years, the debt is forgiven.

This is a good deal for the student: over their lifetimes, men earn £430k more, and women £260k more, than those without a degree. Even after accounting for higher taxes and loan repayment, a graduate can expect to earn £100k more than a non-graduate.

For the government, this is not that good a deal:

One thing that is clear, is that over the last decade, to too great an extent policy has been driven by arcane, and often borderline insane, public sector accounting rules. If we had something called a ‘graduate tax’ then the full annual spending of over £20 billion a year on undergraduate education would count against public borrowing. Under the rules in place when it was introduced, the almost identical student loans system added precisely nothing to borrowing, despite the fact that only about half was ever expected to be repaid.

Outlook

Britain has managed to increase its spending on health and pensions while keeping overall government spending at about 40% of GDP. This is largely due to cuts to defense spending, from 10% in the 1950s to 2% today. This trick can’t work any longer — to remain in NATO, it must spend at least 2% of national income on defense.

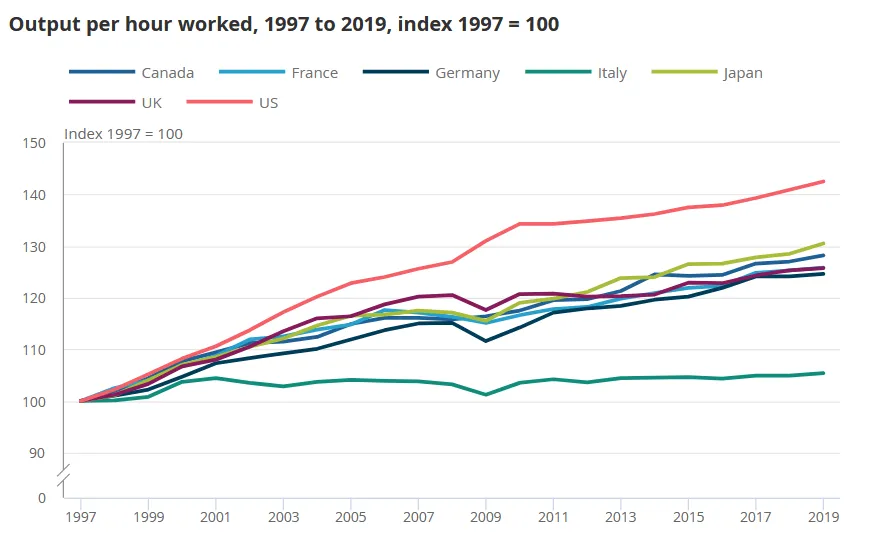

Poor productivity growth in the 2010s has meant that the tax base has not grown as fast as the demands on the budget. Annual interest payments on debt are expected to hit £100 billion. Taxes, historically stable at about 33% of national income, are projected to exceed 37%.

So, we enter the middle years of the 2020s in worse economic straits than at any time I can recall. The financial crash of 2008/09 feels like ancient history, but its effects on our living standards, and on tax revenues and public spending, are clear all around us. Brexit is an ongoing shock to the economy. Covid, 2022’s energy price spike, and inflation spiralling to levels not seen since I was a child in the 1970s, have made things even more difficult.

Thoughts

A brief international comparison

Compared to most developed countries, the UK’s current receipts and expenses as a proportion of GDP are about average. But it spends beyond its means, so deficits and debt are worse.

An ageing population

An ageing population — and its related problem, falling fertility — is a much bigger deal than I thought. NHS spending, already at £150 billion/year, is projected to grow to £250 billion/year in the 2030s.

By 2045, the Office for National Statistics predicts the number of working age people to increase by 4.5% and the number of pensioners to increase by 11%. And given an increase in life expectancies, we should expect more people-years of poor health for the elderly. Spending on pension, health and social care must increase (currently 40% of total government spending), while the tax burden will grow larger per person. This looks unsustainable.

The main lever that I can see in the near term is to reduce rate of spending growth on pensions. Remove the triple lock, reduce the generosity of the state pension, increase the pension age more quickly than scheduled, rely more on private pensions. Health and social care spending increases seem inevitable.

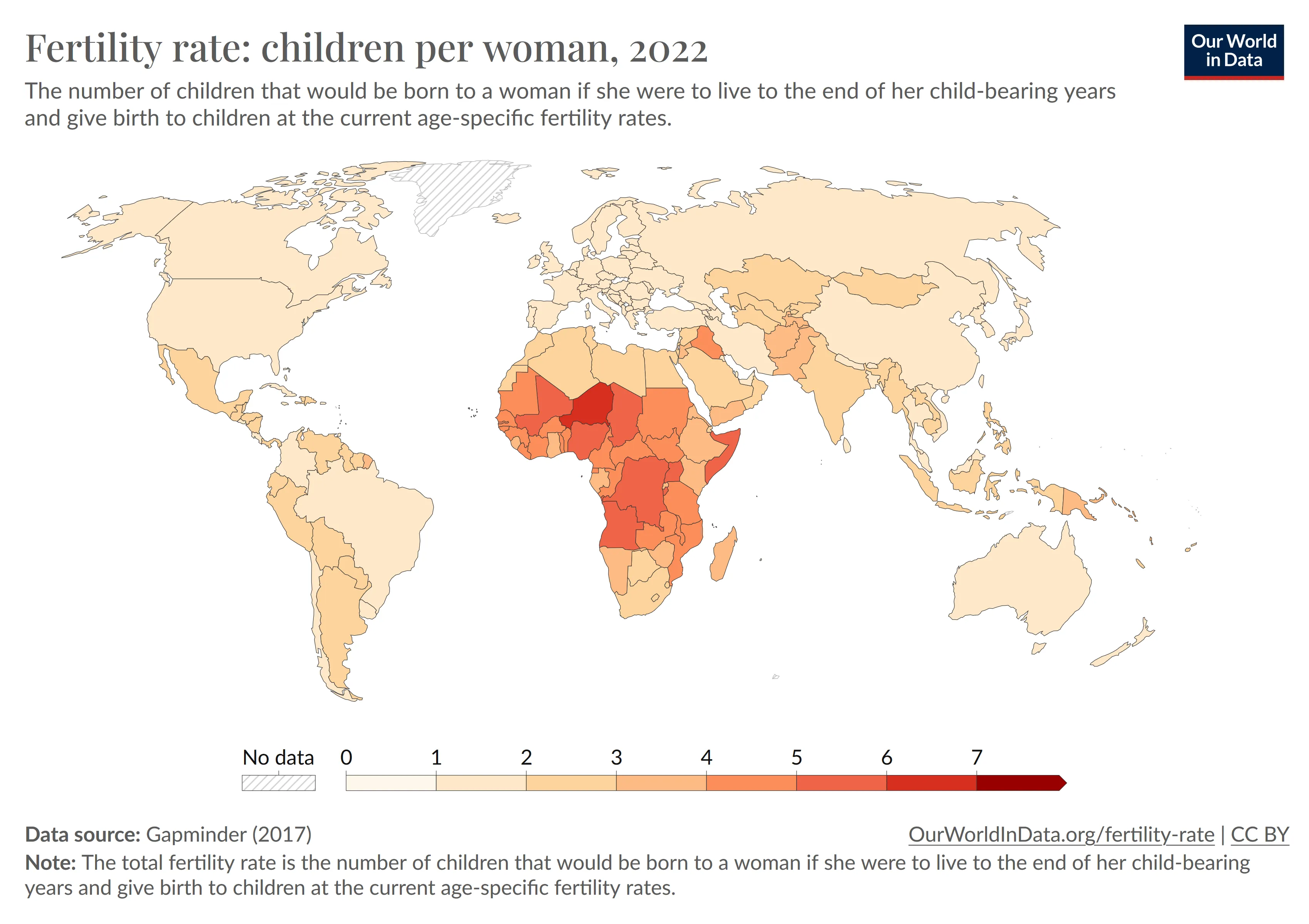

In the long term, fertility needs to increase. This seems to be a problem across the entire world.

Brink Lindsey and Robin Hanson have written about some of the other effects of a falling fertility, including a reduction in innovation, cultural stagnation, and a decline in economic growth.

State capacity

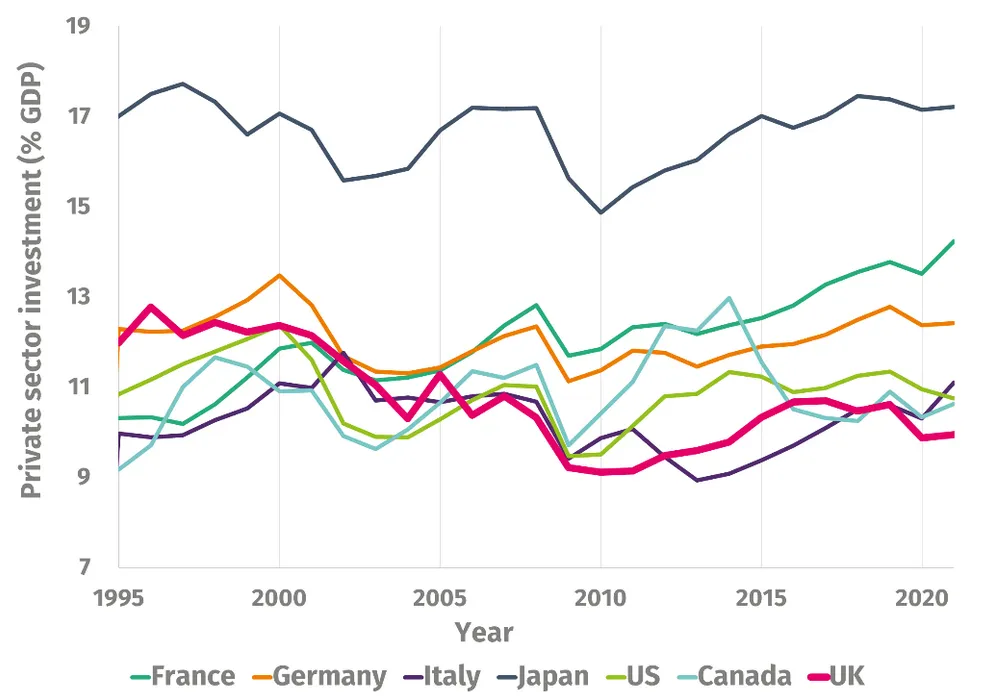

There have been 4 prime ministers and 6 chancellors of the exchequer since 2016. A lack of political stability is bad for private investment, where Britain fares particularly poorly.

Because of frequent changes government planning also becomes difficult, which is sort of understandable, if you ignore that they caused the changes themselves. But even beyond that, it seems unable to get even the simple things done. For example, after 4 years of discussion, No. 10 still hasn’t decided between Google Workspace and Microsoft Office for sharing work between teams.

Economic growth

Economic growth can smooth over a lot of problems. If income keeps growing, tax rates don’t need to rise to maintain the same level of spending. But economic producitivity growth in the UK has stagnated.

By some measurements, the US and France are 30% more productive than the UK. The UK’s output per hour has been nearly constant since 2008.

The bad news is that the economy looks poor; the good news is that there’s a lot of low-hanging fruit to improve things. I will end with Johnson’s prescriptions for growth:

- Political and macroeconomic stability, to encourage private investment.

- Education, especially adult and vocational training.

- Investment in infrastructure like transport, energy, and broadband.

- Tax reform to make the housing market more efficient, to make it easier for businesses to sell, and to make tax minimization less worthwhile.

- Free trade with the EU.

- Fix the planning system, to encourage housing and development.